Tue, 04 Mar 2025

Prime Minister Shri Narendra Modi motivate the SME manufacturer to go Global with the New Government

Prime Minister Sh. Narendra Modi addresses the SMEs in the post budget webinar organised by MSME and inspire the SMEs to go global with the supportive policies of Government of India

Thu, 01 Apr 2021

8 FAQs Around GST Annual Return-GSTR 9

The GST annual return (GSTR 9) is a statement of return required to be filed annually by each registered person (except few specified categories of persons) under GST. It gives summarized details of outward supply and taxes paid thereon , input tax credits claimed, taxes paid, and refund claimed in the financial year in respect of which such annual return is filed.

Fri, 29 Jan 2021

Economic Survey 2020-21 : Press Conference by Chief Economic Advisor Dr KV Subramanian

The Chief Economic Adviser (CEA), Dr Krishnamurthy V. Subramanian along with his team will address a Press Conference after the Economic Survey 2020-21 is tabled in both the Houses of Parliament by the Union Finance Minister Nirmala Sitharaman

Wed, 20 Jan 2021

Arrest Under GST: Caution Needs To Be Applied

ARREST न केवल किसी व्यक्ति के व्यवसाय को प्रभावित करता है, बल्कि यह व्यक्ति को मानसिक और शारीरिक रूप से बर्बाद कर देता है। गिरफ्तारी की शक्ति सरकार के वैध बकाया की वसूली के लिए क़ानून में दी गई है, व्यवसायियों को आतंकित करके वसूली उपकरण के रूप में उपयोग करने के लिए नहीं।

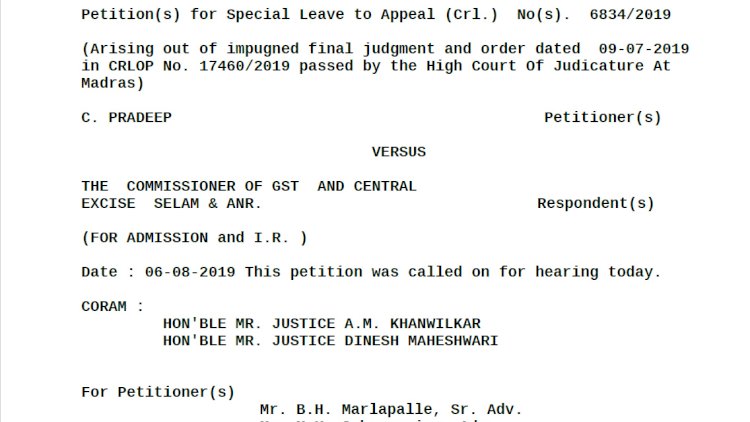

Tue, 20 Aug 2019

Supreme Court judgement- only 10 % of the estimated evasion of GST is to be deposited for no co

In a landmark decision of suit filed by JC Group, COIMBOTORE,( lead and Batteries manufacturing company) against the harassment of GST Department, only 10 % of the estimated evasion of GST is to be deposited for no coercive action.